InsightSync is a newcomer that positions itself as an all-in-one account-based marketing (ABM) and competitive intelligence platform.

It aims to centralize your target account management, engagement tracking, and even competitor research into a single hub.

In theory, it promises ABM pros a streamlined workflow from monitoring industry news to tracking prospect engagement, all under one roof.

But here come big questions: Does InsightSync deliver meaningful value, or is it a jack-of-all-trades?

And at its price point, is it overkill for most teams?

In this article, I’ll show you all the ABM features that InsightSync brings to the table, help you decide if it’s actually the right fit or just overkill, and suggest a lighter but effective alternative (spoiler: a lean LinkedIn-first ABM approach with ZenABM).

Let’s get started!

In case you want it short:

1. What is InsightSync

A unified platform combining competitive intelligence, account-based marketing, and engagement tracking in one AI-powered tool. The idea is to eliminate data silos and give sales and marketing a shared view of both external insights and account activities.

2. Who should care

Mid-sized B2B teams (especially in Europe) that juggle competitive research and ABM programs, and want a single source of truth. If you’re drowning in competitor newsletters and struggling to align sales on target accounts, InsightSync’s approach might appeal.

3. Key capabilities:

InsightSync has three rolled into one ABM platform.

Let’s break down each:

This is arguably what sets InsightSync apart from typical ABM-only platforms.

The Competitive Intelligence (CI) Hub is all about staying on top of your competitors and market trends.

Key highlights:

InsightSync aggregates content about your competitors from various sources like news articles, press releases, and blog posts.

Instead of you curating feeds manually, it pipes them into one dashboard.

You can tag and categorize items, making it easy to filter by topic or competitor. There’s even a ‘like’ feature to mark important tidbits and a sharing tool to quickly pass critical intel to coworkers.

The platform also lets you set up custom news alerts triggered by certain tags or keywords, so you don’t miss big developments (e.g. you could tag “Acquisition” and get alerted if any competitor gets acquired).

CI Hub builds structured profiles on each competitor.

Here, you can log details like who the competitor’s customers are, what partners or alliances they have, notes on their pricing strategies, and their messaging angles.

This feature acknowledges that a lot of competitive intel and market research lives in documents like PDFs, whitepapers, internal reports, etc.

InsightSync provides an AI-powered search that can ingest documents and then let you query them or extract key points automatically.

Next is the core ABM Hub, which helps you answer:

It’s the traditional account-based marketing module.

Key capabilities of the ABM Hub:

You can import or build your target account list (TAL) right into InsightSync. If you have a list from your CRM or a CSV, you can upload it.

Once inside, each account becomes a trackable entity in the platform.

You can enrich accounts with details like industry, size, existing tech, etc., either via integration or manually.

Once your target accounts are in, InsightSync tracks their engagement across channels (ads, emails, and meetings) in one timeline.

The platform even lets you score engagement to quantitatively gauge heat: e.g. assign points for a webinar attended or a demo request.

Accounts with high scores bubble up as more sales-ready.

InsightSync shows real-time data on which accounts are trending toward conversion and which are falling behind.

The benefit is that you can act fast, focusing attention on accounts that are “moving toward conversion” and adjusting tactics for those that aren’t.

In terms of optimization, because you see engagement per account, you might decide to reallocate ad budget to high-engagement accounts or personalize content for them.

InsightSync pitches that you can scale your ABM program with them as you grow.

It mentions automated workflows to scale personalized outreach, though specifics aren’t detailed.

One thing to note: InsightSync’s ABM Hub is channel-agnostic in theory (ads, email, etc.), but it does not have a native advertising network or marketing automation built in. It’s not like Demandbase or RollWorks, where you can actually launch ads from the platform. You’ll still execute campaigns in LinkedIn, or HubSpot, or whatever tools you use, then InsightSync pulls in the results for attribution and analysis.

For teams heavily focused on LinkedIn Ads as their ABM channel, a tool like ZenABM might provide a more direct solution since it ties into LinkedIn through the official ads API.

It pulls company-level clicks, impressions, engagement, and ad spend for each specific ad and campaign group, then scores accounts based on the same, syncs all this data to the CRM as company properties, and assigns hot accounts to BDRs for outreach automatically.

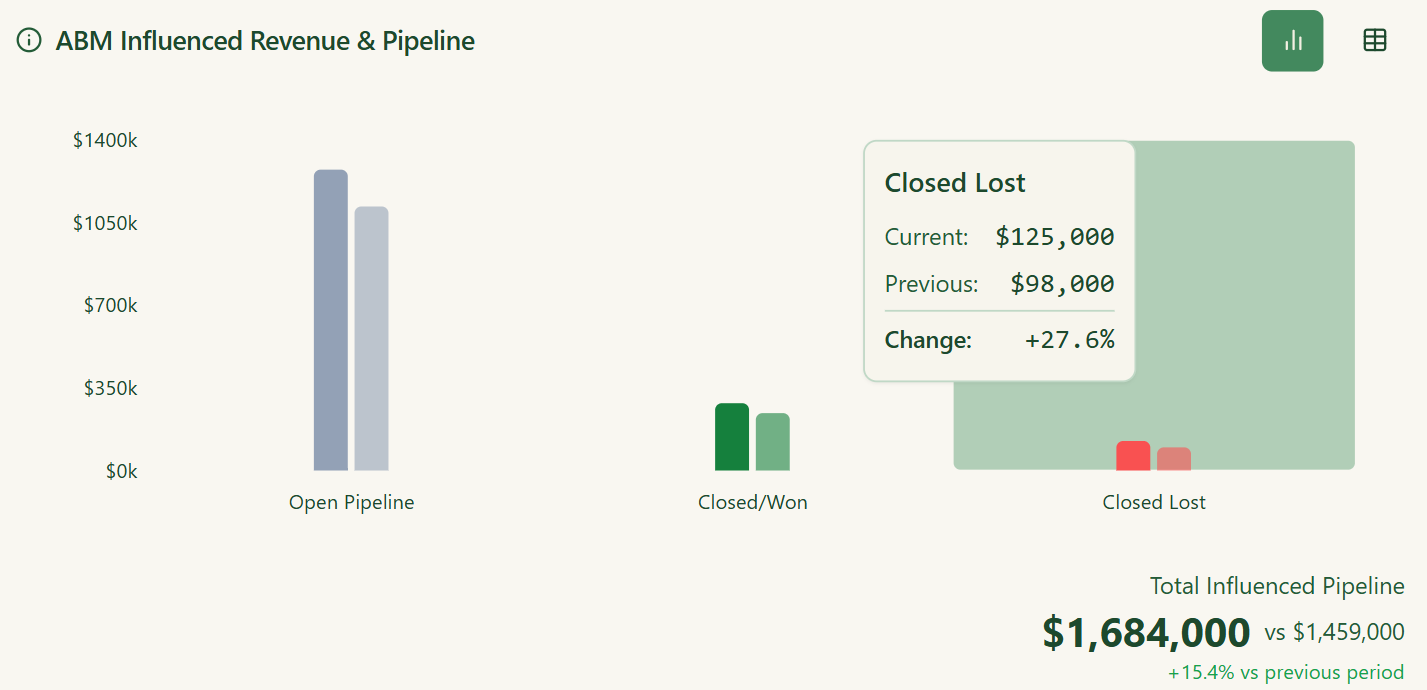

Finally, it matches ad-engaged companies to the ones in your CRM deals and lays out revenue analytics and attribution dashboards, so you can see the real impact of your LinkedIn ads ABM strategy on revenue and pipeline.

InsightSync’s Engagement Hub offers a unified view of account activity by aggregating key signals like web visits, ad clicks, email opens, and event attendance across contacts.

It surfaces trends such as rising interest or sudden drop-offs, helping teams prioritize high-value accounts and re-engage those going quiet.

At the contact level, it reveals individual behaviors like who viewed pricing pages or skipped webinars, so reps can tailor outreach and marketers can refine messaging.

These insights help map buyer roles and intent, infer funnel stage, and guide timely actions.

While not an execution tool, the Hub aims to align marketing and sales through a shared lens of account engagement and behavioral data.

Let’s talk money.

InsightSync’s pricing is relatively premium, clearly aimed at businesses willing to invest in an all-in-one solution.

Here’s the breakdown of their plans (as of late 2025):

Overall, InsightSync’s pricing positions it in the upper mid-market range. It’s not as expensive as the big enterprise ABM platforms (which can run into tens of thousands per year easily), but it’s also not a casual $99/mo tool.

If you consider it consolidates a competitor monitoring tool + an ABM analytics tool + maybe a basic CRM, you might justify the cost.

Still, for perspective, many ABM-focused startups or smaller programs might balk at ~€8k+ per year starting cost.

This is where alternatives like ZenABM emphasize being “lean.”

ZenABM starts at ~$59/month for a starter plan, which is literally a fraction of InsightSync’s price.

Of course, ZenABM is a narrower tool (focused on LinkedIn), whereas InsightSync covers more bases.

It comes down to which capabilities you truly need and will use.

Honestly, there’s not much to discuss regarding user reviews because the tool is young, yet this is what I could find:

In summary, the jury is still out on InsightSync in terms of broad user feedback.

It’s an ambitious platform with a compelling pitch, but you may have to be your own judge by trying it. If you do pilot it, keep an eye on whether both your strategy folks (competitive intel, strategy, product marketing) and execution folks (demand gen, sales reps) actually adopt it.

The true measure of its value will be if it becomes that shared workspace they tout, versus just another tool marketing logs into while sales sticks to CRM.

The testimonial hints that, at least at Riverty, it achieved that cross-team alignment.

If it can do that for your org, it might be worth the price tag.

It wouldn’t be a fair analysis if we didn’t consider alternatives, especially for those reading this and thinking, “InsightSync sounds powerful, but do I really need all of that (and can I afford it)?”.

One alternative in the ABM arena, particularly for LinkedIn-focused ABM, is ZenABM.

Let’s look at its core ABM features:

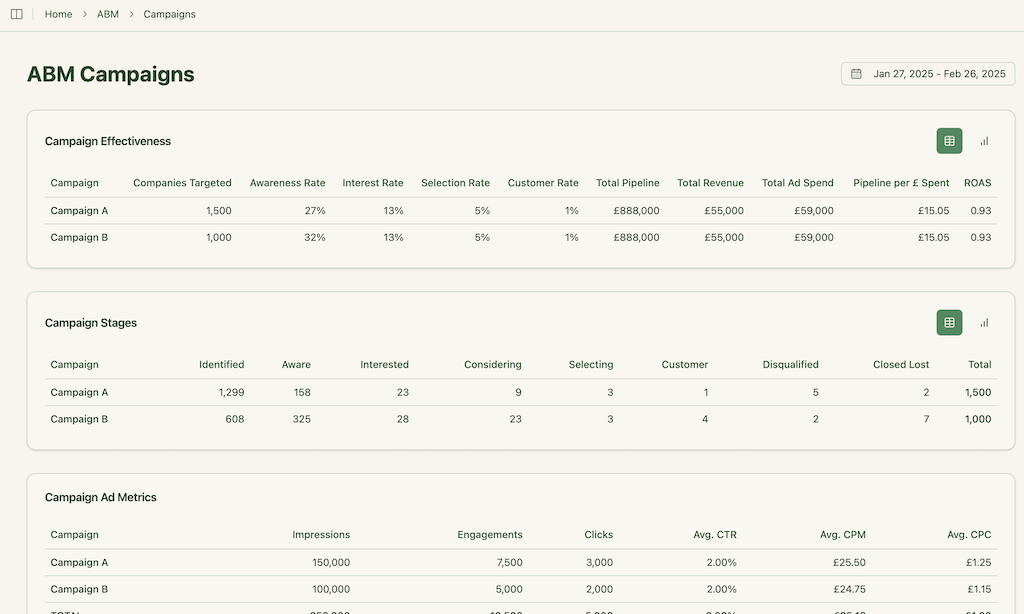

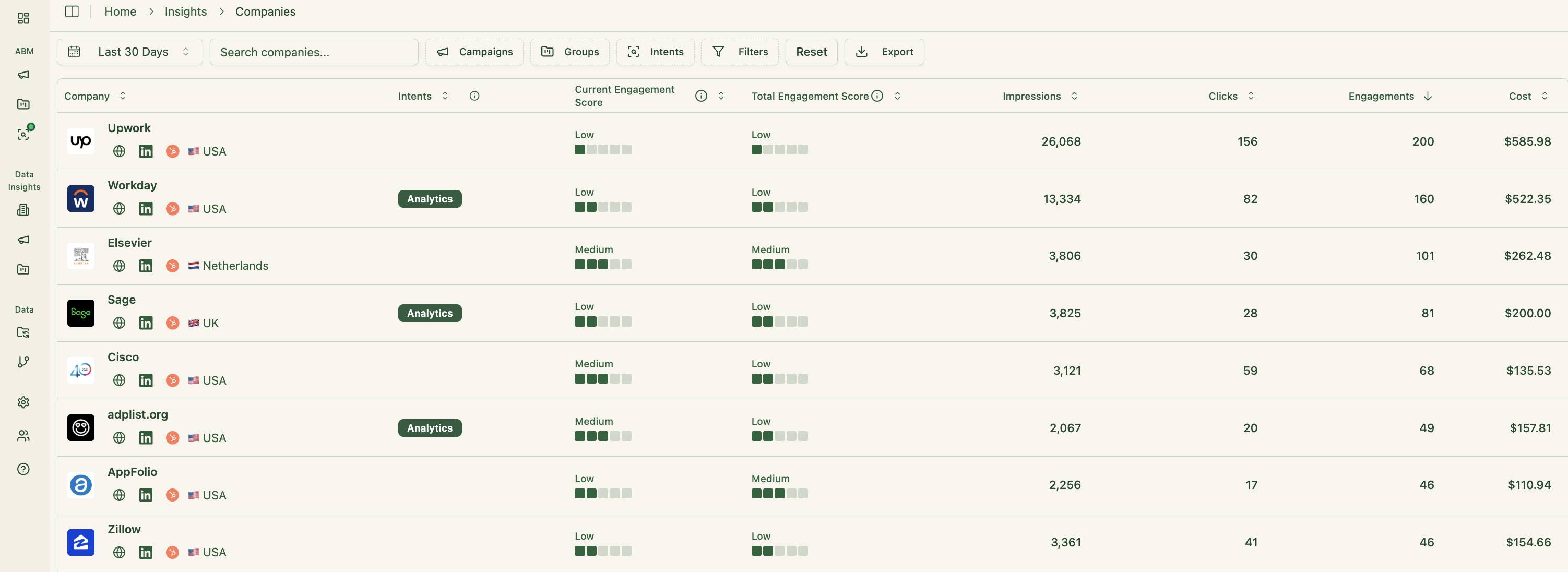

ZenABM integrates directly with the LinkedIn Ads API to pull account-specific data from all campaigns.

This allows you to identify precisely which target accounts are interacting with your LinkedIn ads (impressions, clicks, etc.), all mapped to individual companies.

Pro Tip: ZenABM can also reveal anonymous website visitors for free. Retarget them with inexpensive LinkedIn text ads, and ZenABM will identify the companies that saw your impressions.

ZenABM continuously updates engagement scores from ad interactions. You can monitor recent trends (like the past week) or historical patterns to identify accounts heating up.

These scores help marketing and sales prioritize high-value accounts for follow-up.

ZenABM enables you to define your ABM funnel stages (e.g., Identified → Aware → Engaged → Interested → Opportunity) and automatically classifies accounts using engagement and CRM information.

You can set your own thresholds for “Engaged” or “Interested,” and ZenABM will track stage transitions automatically.

This delivers full-funnel visibility like enterprise ABM platforms, highlighting where accounts stall and where progress accelerates.

ZenABM integrates bidirectionally with CRMs such as HubSpot (Salesforce available on higher plans).

LinkedIn engagement data feeds directly into your CRM as company-level properties, keeping sales teams informed:

ZenABM can auto-update account stages to “Interested” when engagement passes a set threshold and assign accounts to specific BDRs for follow-up.

ZenABM allows you to tag campaigns by theme (like “Feature A” vs. “Feature B”) and shows which accounts engage with which themes, revealing their priorities.

This is genuine first-party intent. Instead of paying for inferred keyword interest, you get direct proof like Account Z clicking “Feature A” ads, demonstrating actual buying interest.

These insights also sync to your CRM, supporting highly targeted outreach and relevant messaging.

Your sales reps can instantly see which topics or pain points each account reacts to most.

ZenABM includes pre-built ABM dashboards linking ad exposure, engagement, funnel stages, and pipeline metrics.

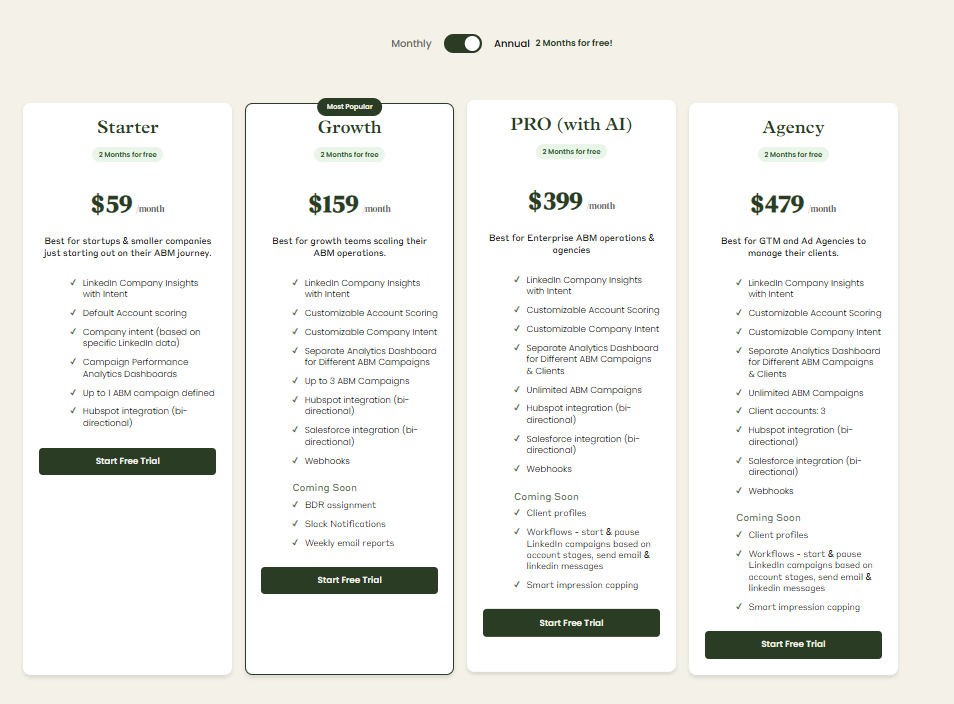

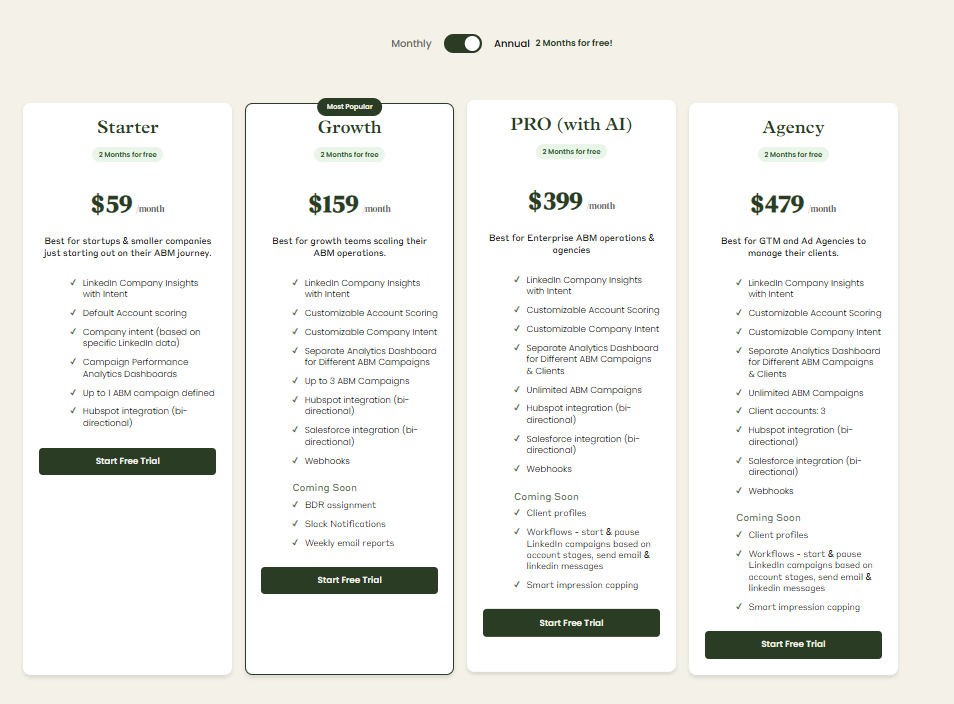

Plans start at $59/month for Starter, $159/month for Growth, $399/month for the Pro (AI) tier, and $479/month for the agency tier.

Even the highest tier costs under $7,000/year, far less than InsightSync.

All plans cover essential LinkedIn ABM functions, with higher tiers mostly expanding limits or adding Salesforce integration.

Pricing is flexible (monthly or annual with two months free), and a 37-day free trial allows teams to try before buying.

InsightSync offers an all-in-one ABM and competitive intel platform, but its €699+ price tag and setup demands make it best suited for mid-sized teams with complex needs.

For leaner teams focused on LinkedIn-driven ABM, ZenABM delivers focused insights, CRM sync, and intent data starting at just $59/month, making it a simpler, smarter fit for most.

In fact, ZenABM’s first-party qualitative intent tracking and plug-and-play ROI attribution for each ad are unique features that make it worthwhile even as a complementary layer to bigger suites like InsightSync.